Since 1975 Australian governments began the charge to sell off publicly owned and run enterprises.

They had accepted the dogma of the economic rationalists that enterprises should be privately run.

This was part of a world wide trend in advanced capitalist countries, a shift from Keynesian economics that led to the New Deal in the US during the great depression to that of the conservatism of the Chicago school of Economics led by people like Milton Friedman and others.

In Australia the sale of public assets has been the province of the Department of Finance and Deregulation in one form or another since the late 1980s when the Hawke Labor government began the sell off.

Since August 1990 the decision to restructure the Commonwealth Bank in preparation for a partial public float heralded a series of major full or partial privatisations, including:

Commonwealth Bank

Qantas and Australian Airlines

Commonwealth Employment Service

Telstra (announced October 1997)

Major airports

Moomba-Sydney gas pipeline

National electricity transmission network

DASFLEET

At the same time there were sharp reductions in the numbers of public servants under the guise of a drive for efficiency.

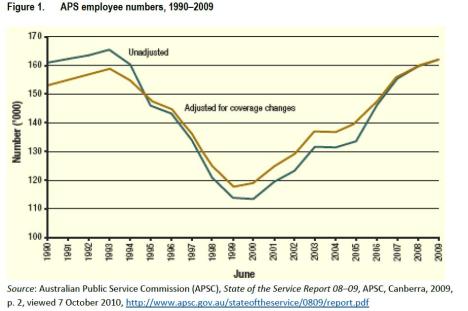

A decline in staff numbers took place from 1987 to 1990 followed by a modest increase from 1990 to 1993.7 From 1993 to 19992000 there was a very steep decline in staff numbers followed by an upwards trend from 2000 onwards. In 2009, staff numbers were similar to absolute staff numbers in 1990. The following figure illustrates the trends in APS employment since 1990.8

From the 1980s most government departments were forced to adhere to an ‘economic dividend’ which meant a 2% reduction in funding annually.

The economic rationalists idea of efficiency was translated into loss of government services especially in regional Australia but also in crucial areas like the Commonwealth Employment Service in the towns and cities.

The sale of Telstra brought in $40billion and effectively kept the Howard government in power for 10 years because at each election when the government got into trouble it gave handouts to buy votes.

Needless to say this method of economic management came under greater scrutiny by the public on the arrival of the global financial crisis of 2008-2009. Interest rates on housing loans kept going up in Australia as a result of government regulation of monetary policy. The pain became too much and the Howard government was kicked out when it tried to combine conservative monetary policy with a tightening of the labour laws under WorkChoices legislation.

Along came a Labor government which increased the power of the ALP considerably becasue it held government in all states and territories. Labor treasurers competed with each other to so their conservative economic credentials. However at the same time Meanwhile the economic rationalists at the Chicago school, which advocates for unfettered free markets and little government intervention, came under attack in the wake of the financial crisis of 20072010.[17] The school has been blamed for growing income inequality in the United States.

Growing income inequality here led to riots in the western suburbs of Sydney and disquiet in regional Australia with the ongoing decline in rural industries. At times this was reflected in the domestic political scene. One example was when One Nation captured nearly a quarter of the vote in Queensland at its first outing in the late 1990s. Also Jeff Kennet was dumped unexpectedly by Victorian voters because his privatisation binge took away essentail services like electricity, gas, water and transport.

Undaunted by international experience Labor persisted with its time worn economic policies. The private sector had enjoyed the ride becasue the sale of public assets shifts a lot of wealth to keyindividuals and institutions like banks and superannuation funds.

Anna Bligh has decided to gamble that the money from privatising Qld Rail, the last publicly owned commercially viable railway in Australia will enable her to buy sufficient votes to win the 2012 election. The government puts up facile arguments in favor of sale of

- QR National

- Port of Brisbane

- Queensland Motorways

- Abbot Point Coal Terminal

- Forestry Plantations Queensland

Federally, along comes Ms Moneypenny Wong to head up Department of Finance and Deregulation.

Will she continue with the sale of public assets advocated by Hawke, Keating, Kennett, Howard, Rudd and Bligh or will she reign in the madness? I will be looking specifically at government rhetoric like ‘reducing budget deficit’, ‘reducing debt’, ‘improve our credit rating’, ‘proceeds spent on other things’ (hospitals, schools, roads?), ‘reducing risk’, ‘increasing efficiency’, ‘reducing costs’, ‘selling like the rest,’ ‘selling before the price falls’.

Ian Curr

October 2010

References

See Public Asset sales and the Commonwealth Banks Restructuring Bill 1990, Bills Digest (8 November 1990)

Chronology of changes in the Australian Public Service 1975-2010, Parliamentary Library, October 2010. The purpose of this chronology of key events is to provide a historical context in which to understand the continuing evolution of the Australian Public Service (APS). See http://parlinfo.aph.gov.au/parlInfo/download/library/prspub/279779/upload_binary/279779.pdf;fileType%3Dapplication%2Fpdf